Delaware franchise tax

Exempt domestic corporations do not pay a tax but must file an Annual Report. Authorized Shares method and a minimum tax of $400. The minimum tax is $ 175. Assumed Par Value Capital Method.

Large Corporate Filer, then their tax will be $25000. Taxes are assessed if the. When a company falls behind on paying franchise tax and good standing is lost, the shield goes down, exposing the company owner’s personal assets to creditors of the company.

Domestic corporations must file by March or face a $2penalty, and a 1. Who has to file and pay? Franchise taxes are generally due in arrears for the prior calendar year. I am not a Franchise why do I owe Franchise Tax?

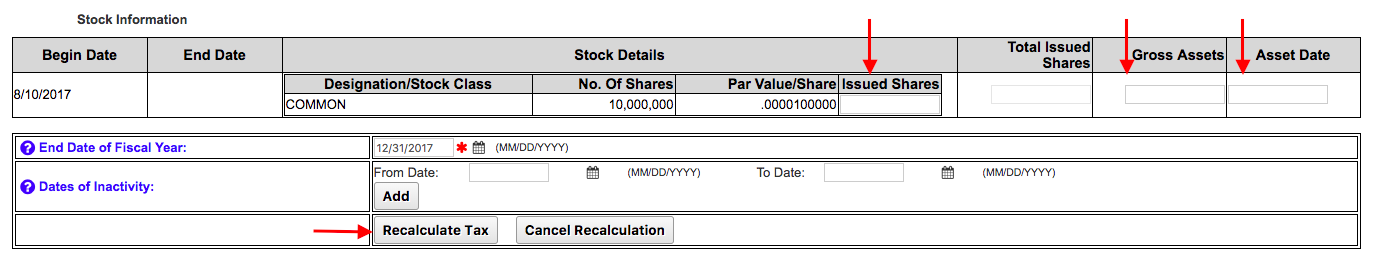

Delaware Annual Report and Franchise Tax Costs. But if we calculate it the other way, we only need to pay $350. Save time and reduce errors when you file your taxes online! You should calculate your taxes under both methods to determine, which method is less expensive.

If the annual franchise tax report and the franchise tax due are not filed or paid by the corporation as required by this chapter, the Secretary of State shall ascertain and fix the amount of the franchise tax as determined in the manner prescribed by § 503(a) of this title and the amount so fixed by the Secretary of State shall stand as the basis of taxation under the provisions of this. You must compledte and file an annual report.

Please note: this is only an estimated Franchise Tax amount due. If applicable, this estimate does not include any past due Franchise Tax amounts. Other additional fees may apply when filing. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity.

A franchise tax is not based on income. Every corporate is required to pay a Franchise Tax and file an Annual Report. There is a minimum tax and fee of $225.

There’s an added fee of $to file the annual report. For each additional 10shares, add $to the tax total, with a maximum franchise tax of. This is a requirement to keeping your LLC in compliance with the state.

When you pay the franchise tax, you’re actually paying for the previous year—the franchise tax paid in any given year is for the preceding calendar year. Relationship to corporate tax. States with higher corporate income taxes usually have low or no franchise taxes and vice versa.

Method of Filing Your Annual Franchise Tax can only be paid online and cannot be filed by mail. You can make payment using a credit card or your checking account. Schedule of Franchise Tax Corporate Franchise Tax. Religious and charitable non-stock corporations are exempt from the tax but must file an annual report.

Fortunately for LLC owners, the annual tax is straightforward. Calling this annual tax a " franchise tax " does not mean that your company is an actual franchise business. A tax shelter is any method thatin the recovery of an amount over $in tax in exchange for every $someone spends during a four-year period.

If any officer or director of a corporation required to make an annual franchise tax report to the Secretary of State shall knowingly make any false statement in the report, such officer or director shall be guilty of perjury. Some entities are exempt from franchise taxes including fraternal organizations, nonprofits, and some.

Yorumlar

Yorum Gönder