Corp delaware tax

Do corporations pay taxes in Delaware? What is the minimum tax for a corporation in Delaware? Do I have to file a franchise tax report in Delaware? There is no requirement to file an Annual Report.

Taxes for these entities are due on or before June 1st of each year. Penalty for non-payment or late payment is $200.

By comparison, the state’s personal income tax rate varies zero for nominal personal income to a highest rate of 6. Authorized Shares method and a minimum tax of $400. The minimum tax is $ 175. Assumed Par Value Capital Method. You may now also reserve names, check status of an entity and corporate history online.

For the S- corp, the tax is paid through the individual shareholders. It means the tax payment is dependent on each shareholder of that income.

Exempt domestic corporations do not pay a tax but must file an Annual Report. Domestic corporations must file by March or face a $2penalty, and a 1. This is not an indication of the current status of an entity.

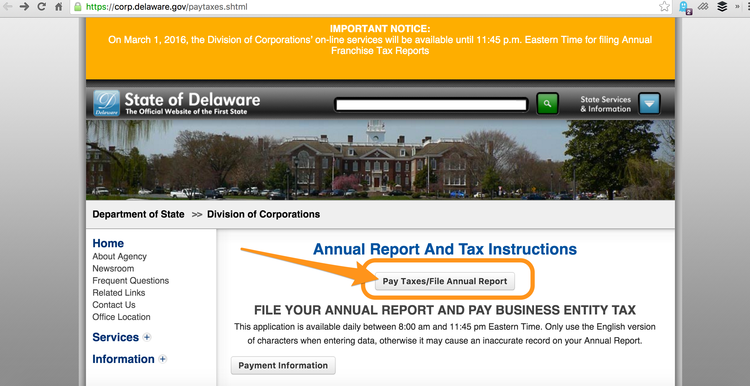

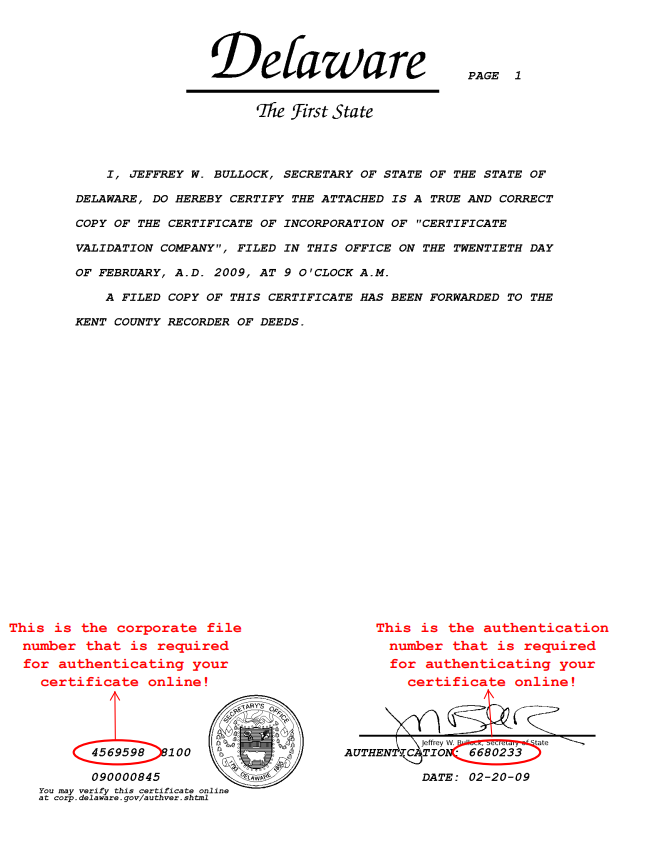

When the list of names. Please enter your Business Entity File Number below to start filing your Annual Report or Pay Taxes.

If the tax is not paid on or before Marchthe state imposes a $2late penalty, plus a monthly interest fee of 1. Other products made with tobacco also had their rate increased. Cigars and tobacco, for example, increased the tax rate by percent of the purchase price. Delaware does not levy corporate tax on S corporations. Revenue win for them, tax and.

If any officer or director of a corporation required to make an annual franchise tax report to the Secretary of State shall knowingly make any false statement in the report, such officer or director shall be guilty of perjury. For help on a particular field click on the Field Tag to take you to the help area.

Extra Franchise Taxes. Corporations may pay the tax before March 1. For a corporation with under 0shares, the tax is $1plus a $filing fee. If you cannot file by that date, you can request a state tax extension.

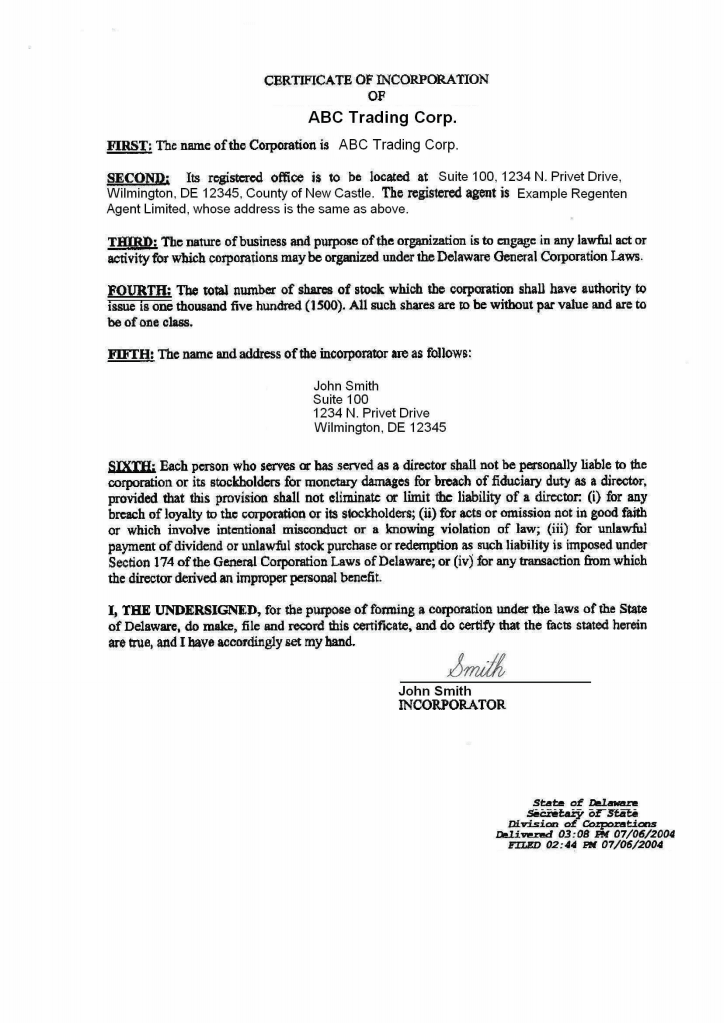

Opening a bank account One of the most commonly asked questions about forming a business in the United States from abroad is how to open a business bank account. Delaware’s business law is one of the most flexible in the country.

Investment bankers often require publicly traded companies to incorporate. This is a great advantage for C corporations, as they are taxed at the corporate level, meaning any revenue the corporation receives is taxed at the entity level before it is distributed as salary.

If any corporation, accepting the Constitution of this State and coming under Chapter of this title, or any corporation which has heretofore filed or may hereafter file a certificate of incorporation under said chapter, neglects or refuses for year to pay the State any franchise tax or taxes, which has or have been, or shall be assessed against it, or which it is required to pay under this. You can leave a message if Live Support is offline. Harvard Business Services, Inc.

Who has to file and pay? Although it’s the second smallest state in the U. S corporations are corporations that elect to pass corporate profits or losses through to its shareholders for federal tax purposes.

Shareholders of S corporations report the flow-through of profits and losses on their personal tax returns and are assessed tax at their individual income tax rates. This is a requirement to keeping your LLC in compliance with the state.

Yorumlar

Yorum Gönder