Delaware corporate tax

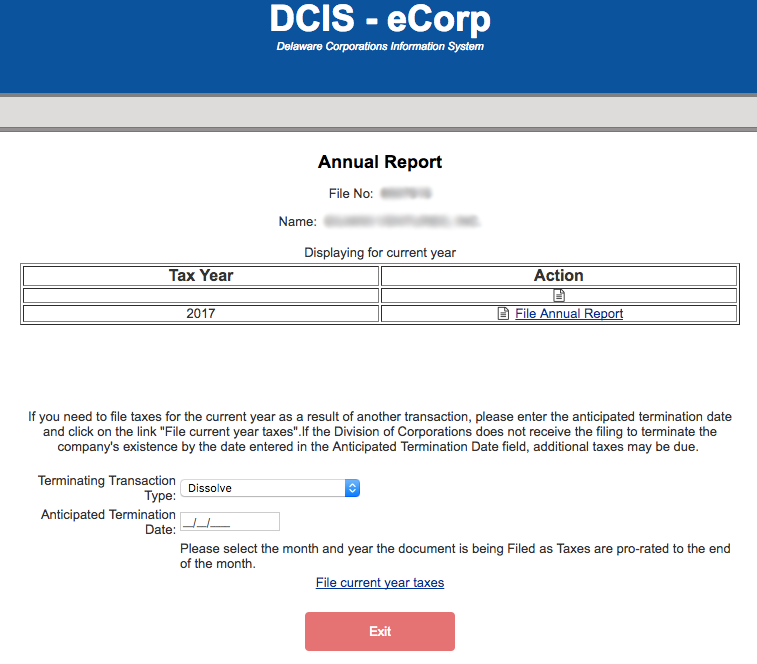

Corporate Annual Report and Franchise Tax Payments. Delaware corporations are also subject to a more. Exempt domestic corporations do not pay a tax but must file an Annual Report. The filing fee for filing an Annual Report or Amended Annual Report for exempt domestic.

The minimum tax is currently $175. Authorized Shares Method and the Minimum Tax using the Assumed Par Value Capital Method is $400. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.

A tax shelter is any method thatin the recovery of an amount over $in tax in exchange for every $someone spends during a four-year period. This tax is based on an equally weighted three-factor method of apportionment. The Franchise Tax for a corporation is due by March of every year.

If the tax is not paid on or before Marchthe state imposes a $2late penalty, plus a monthly interest fee of 1. The limited partnership (LP) Franchise Tax is also due by June of every year. The penalty for not filing a completed annual report on or before March is $125.

An additional interest rate of 1. Domestic corporations must file by March or face a $2penalty, and a 1. According to the state, “the total tax will never be less than $175. Click the tabs below to explore!

If you cannot file by that date, you can request a state tax extension. The state helps companies legitimately reduce their United States taxes an sometimes, obscure profits in other countries.

Companies are able. Partnership tax returns are due by March 15th — or by the th day of the 3rd month following the end of the taxable year (for fiscal year filers). Gross receipts tax rates range from 0. If any corporation, accepting the Constitution of this State and coming under Chapter of this title, or any corporation which has heretofore filed or may hereafter file a certificate of incorporation under said chapter, neglects or refuses for year to pay the State any franchise tax or taxes, which has or have been, or shall be assessed against it, or which it is required to pay under this.

The taxes include federal income tax and state income tax. Financial institutions are. This includes interest and investment income as. Sales of tangible personal property are also subject to a retail or wholesaler license and gross receipts tax.

Many taxpayer-related. Learn more below about the state’s various programs to grow the state’s economy through helping companies, like yours, succeed. On or before November in each year, the Secretary of State shall notify each corporation which has neglected or refused to pay the franchise tax or taxes assessed against it or becoming due during the year or has refused or neglected to file a complete annual franchise tax report, that the charter of the corporation shall become void unless such taxes are paid and such complete annual.

IMPORTANT INFORMATION ON CERTIFICATE VALIDATION. You may only validate a certificate for year from the date that it was issued. This $3fee is standard protocol for every LLC, regardless of its age, gross sales, activity or periods of inactivity. STATE OF DELAWARE.

Some tax credits are refundable, and others are not. One main benefit noted by Kiplinger was no state sales tax. Not all states with no sales tax were included in the list because of income taxes and property taxes.

Small businesses can reach out to the Division for assistance in connecting to the resources and advice to succeed.

Yorumlar

Yorum Gönder